Building a reliable income for retirement feels a lot less scary when you have more than one stream of income. Affiliate marketing can give you the chance to create ongoing passive earnings, but making it actually last for the long haul takes some planning and smart strategies. Here’s how I approach optimizing affiliate marketing for long-term retirement income, drawing from experience and plenty of trial and error.

Why Affiliate Marketing Makes Sense for Retirement Income

Affiliate marketing lets you earn a commission by promoting other companies’ products. When someone makes a purchase through your special tracking link, you get paid. What makes it so attractive for retirement is the chance to set up systems that, with the right effort now, can keep earning for you years into the future.

Millions of people around the world tap into affiliate income every day. According to Statista, affiliate marketing spending is set to hit $15.7 billion globally by 2024. One reason I see so many folks gravitating toward it for retirement is that the work can be done from anywhere, it scales well, and it doesn’t necessarily require managing inventory or customer service. If you’re looking for a side hustle or a way to supplement pension or Social Security, affiliate marketing is definitely worth a look.

Getting Started: Setting Up Your Long-Term Affiliate Foundation

The way you start building your affiliate business really sets the stage for later. Here’s how I think about those first steps for a sustainable retirement strategy:

- Niche Selection: Pick a subject area that you have some interest in and is likely to stay relevant for years. Health, personal finance, hobbies, and home improvement are all steady categories. I look for niches that solve evergreen problems, meaning folks will always need solutions.

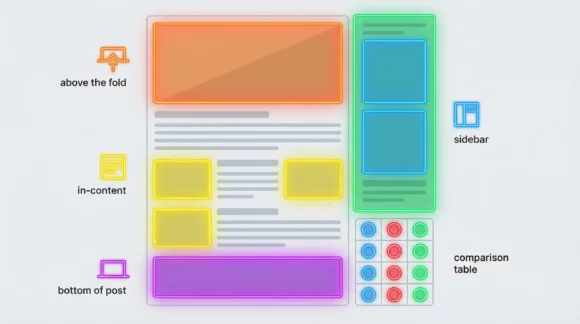

- Website and Content Hub: Most of my affiliate income comes from dedicated websites or blogs. Owning your own platform gives you much more control compared to social media, and search traffic can keep flowing for years. WordPress is popular, but there are site builders out there for all levels.

- Quality Content: The content you publish is what attracts and helps readers and search engines. Focus on helping your audience, not just selling to them. That’s how trust is built, which leads to long-term conversions.

For anyone serious about retirement, set aside the time upfront to do a little research: notice what products you naturally use and recommend, see which programs offer fair commissions, and check if there’s steady demand using basic keyword research tools. These key steps smooth the way for a self-sustaining stream of passive income.

Pillars of Long-Term Affiliate Income

Sustainable affiliate earnings don’t happen overnight. Here are a few things I focus on to help income streams last for years:

- Evergreen Content: Articles and reviews that answer questions people will always have, like “best protein powder for seniors” or “how to set up a raised garden bed,” keep pulling in visitors long after you’ve published them. Updating these pieces regularly helps keep search rankings high.

- High Quality, Reputable Offers: Promoting products from companies that have been around a while cuts down on surprises like sudden program closures or poor customer service, which can impact your earnings.

- Diversification: Working with several affiliate programs and vendors smooths out the bumps when one program makes changes. I never put all my eggs in one basket here; spreading the risk is just smart planning.

Beyond these basics, remember to treat your online presence like a real business. This means keeping good records, treating content like assets, and planning regular reviews of what’s working.

Key Actions for Optimizing Affiliate Marketing for Retirement

- Create Value-First Content: I focus on offering real solutions and helpful tips. Deep guides, comparisons, and case studies do really well over time and naturally attract organic traffic. Search engines love thorough, helpful posts.

- Collect Email Subscribers: Building even a small email list pays off. Sending occasional updates, product recommendations, and fresh content straight to people who already trust you means more conversions and a safety net if search traffic dips.

- Use SEO Strategically: Keyword research tools like Ahrefs, SEMrush, or Ubersuggest are pretty handy for finding topics that have good search volume but aren’t super competitive. Optimizing older posts and updating them regularly is one of the best moves for evergreen affiliate income.

- Automate Where You Can: Tools that help schedule social media, manage email sequences, or update affiliate links when programs change save you time and help keep commissions rolling in.

Adding video content or podcasts can also give your site a boost. Both can attract a new segment of your audience and create more opportunities to connect with companies offering affiliate partnerships in your field.

Things to Watch Out For: Common Affiliate Marketing Challenges

No plan is perfect. Over the years, I’ve run into a few hurdles that can really throw a wrench in retirement income goals:

- Program Changes: Sometimes, companies shut down affiliate programs, change their terms, or lower commission rates. This can mess with your income if you rely heavily on a single source.

- Traffic Drops: Google algorithm updates or seasonal trends might slow down your traffic. That’s why owning an email list and staying active on multiple channels is super important.

- Payout Delays or Issues: It’s not unheard of for affiliate payments to be delayed, especially from smaller companies. Only working with brands you trust makes this less stressful.

- Compliance Rules: Always disclose affiliate links and follow both FTC guidelines and program terms. Violations can lead to lost commissions.

Evergreen vs. Trendy Niches

I get tempted by trending topics sometimes. After all, they can mean quick results. But for retirement income, I stick with timeless and proven niches. These are less likely to fizzle out and require fewer big pivots down the road.

Handling Search Engine Changes

Search traffic is the backbone of most affiliate sites. To handle the ups and downs with Google, I regularly review analytics to spot drops early, mix up keyword targets, and keep my content updated and helpful. This way, I’ve seen posts keep earning for years with minimal tweaks.

Building Multiple Streams for Stability

Affiliate income is awesome, but I never rely on just one offer or website. Over time, I’ve built several sites, each with different niches, so if one slows down, the others help keep income steady. Mini sites, YouTube channels, or even emails with curated offers can add up.

Smart Tools, Resources, and Automation for Passive Affiliate Income

Maximizing automation and using the right tools lets you step back and let your systems work for you, a big plus as you near retirement. Here are a few tools I wouldn’t want to do without:

- Affiliate Link Managers: Pretty Links for WordPress and similar plugins make it easy to manage and change links across a whole site in one place.

- Email Marketing Platforms: Tools like ConvertKit or MailerLite make collecting emails and sending newsletters straightforward, with automation for welcome series, updates, and broadcast offers.

- Content Scheduling: Buffer and SocialBee can schedule posts so your best content keeps reaching new folks, even when you’re focused elsewhere or taking that well-earned break.

- Analytics and Tracking: Google Analytics, Amazon Associates reports, or affiliate dashboard data help spot what’s working, what’s slowing down, and where to double down.

It’s also wise to make use of simple spreadsheets or task tracking tools to keep your routines manageable. That way, even if you step away for a vacation or health reasons, your systems keep rolling and you don’t lose momentum.

Case Study: Turning Affiliate Marketing Into Reliable Retirement Income

About five years ago, I started a blog on a hobby I genuinely enjoyed. I spent the first months writing helpful guides and answering common questions related to the niche, slowly building up traffic through SEO and a small newsletter. I signed up for a handful of reputable partner programs; one focused on physical products, another on digital courses.

Today, that single blog brings in several hundred dollars a month with minimal input. I spend a few hours a month checking for product updates and answering comments, but for the most part, the income stays steady. This helped cover unexpected bills while giving me peace of mind for retirement planning.

Plenty of affiliate marketers have similar stories, especially those who start early, focus on long-lasting topics, and lay a strong foundation. By keeping things simple and approachable, this side income has continued to work for me even during personal distractions or when life just gets busy.

Another great example is a friend who pivoted from full-time teaching to running an affiliate resource website for educational tools. Over several years, they built up a highly engaged audience and now earn a steady monthly amount supporting others in education without sacrificing their own free time.

Frequently Asked Questions

Some questions pop up a lot when talking about long-term affiliate income for retirement. Here are a few I see most often:

Question: Can affiliate marketing really be a stable retirement income source?

Answer: Yes, with the right planning and mixing up your offers. Having several affiliate programs, a focus on evergreen topics, and an email list make the income more predictable and less likely to vanish overnight.

Question: How much do I need to start building affiliate income for retirement?

Answer: You don’t need much cash up front. A domain, basic hosting, and maybe a few tool subscriptions get you started for under $200 a year. The real investment is your time and patience.

Question: What do I do if a big program like Amazon suddenly slashes commissions?

Answer: This is a common situation. I keep a spreadsheet of alternative vendors and regularly review them. Updating older posts, swapping in new offers, and keeping a broad mix of programs is the way to go. Staying sharp and checking your main sources every few months is a lifesaver.

Question: How long does it take to see results?

Answer: Affiliate marketing can take several months to get real traction, especially if you’re relying on SEO. Consistency is key. After several solid months, small commissions become noticeable, and year by year, it can really snowball. If you stick with it, you’ll likely notice real momentum by the six- to twelve-month mark.

Practical Tips for Sustaining Affiliate Income Into Retirement

I keep a few best practices top of mind for optimizing affiliate marketing as a true retirement strategy:

- Keep Learning: Affiliate marketing changes all the time. Subscribing to industry newsletters or joining online groups puts you ahead of new trends, search updates, or fresh program launches.

- Monitor and Update: Set up a regular routine, maybe every two months, to refresh your top posts, update product links, and add new info. Search engines notice!

- Lean on Trusted Brands: Companies with solid reputations treat affiliates better and usually have more consistent payment schedules, which makes long-term planning way easier.

- Balance Promotion With Helpfulness: The most reliable affiliate income comes from sites that put reader experience first. A genuinely helpful article gets more shares, backlinks, and trust, which all feed future income.

Remember, change is always possible. If something isn’t working, there’s no shame in switching up your approach or testing out different platforms and partners. Pay attention to feedback from your visitors and use it as a guide to improve.

How to Build a Retirement-Ready Affiliate Marketing Plan

Setting specific goals makes it easier to track progress. I usually lay out my plan like this:

- Pick three evergreen niches that fit your interests and have active affiliate programs.

- Set up a simple blog or website for each leg of your retirement plan.

- Commit to publishing one useful guide or review per week for six months.

- Set up Google Analytics and sign up for three affiliate programs per site.

- Collect your first 100 email subscribers with a freebie guide or mini course.

Don’t forget to back up your content, keep login details secure, and occasionally check for broken links. Small habits like these protect your hard-earned momentum over time.

Final Thoughts

Affiliate marketing can be a steady and enjoyable way to build extra income as you look toward retirement. With the right planning, a focus on evergreen content, multiple income streams, and good use of automation, it’s possible to create an income source that doesn’t disappear when you step away. Careful research, a commitment to helping others, and a willingness to adapt make all the difference in turning affiliate marketing from a hobby into a key part of your retirement plan.

Whether you’re just starting out or fine tuning your existing affiliate strategy for long-term peace of mind, these steps make it much more likely you’ll have extra cash flow in your later years. No extensive hustle required and you can enjoy retirement with less worry and more freedom.

As someone who transitioned from a long career in healthcare to exploring affiliate marketing for retirement income, I found your article incredibly insightful.

The emphasis on selecting evergreen niches, such as health and personal finance, resonates deeply with me, especially given my background. Your advice on building a dedicated website or blog as a content hub underscores the importance of having a platform that offers control and longevity. I’ve been considering WordPress for this very reason.

The reminder to focus on quality content that genuinely helps readers, rather than just selling to them, is a valuable takeaway. Trust-building is crucial, and your guidance reinforces that.

Thank you for sharing such practical strategies; they provide a clear roadmap for retirees like me aiming to establish a sustainable affiliate marketing income.

Thank you so much for your kind and thoughtful comment! It’s inspiring to hear from someone with such a rich background in healthcare making the leap into affiliate marketing — your perspective adds real depth to the conversation. I’m glad the article resonated with you, especially the focus on evergreen niches and building trust through quality content.

WordPress is an excellent choice for creating a flexible, long-term platform, and with your experience, I’m confident you’ll bring a lot of value to your readers. I wish you continued success on your journey. Retirees like you prove it’s never too late to start something new and impactful!