Knowing how to size up demand in a niche is vital if you’re thinking about starting a business or launching a new product. There’s nothing worse than pouring time, money, and effort into something only to realize nobody cares. The good news? You can spot market opportunities before taking the plunge. With a bit of digging into trends and numbers, you can confidently decide if a niche has the potential you’re looking for.

Many people stick with their gut feeling, but I’ve seen firsthand how much more success follows a systematic approach. If you’re just getting started with market research or assessing niche market demand, I’m here to walk you through the most important steps. By using these steps and gathering the right insights, you’ll avoid wasted effort and give yourself a strong shot at success.

Here’s how to analyze market opportunities and measure real demand for your niche, with practical tips and tools that make it much easier to get started—even if you’re not a data nerd.

Clarify Your Niche and Audience

Everything starts with clearly defining what your niche is. It’s easy to fall into the trap of being too broad, but the real value comes from getting specific. You want to know exactly who you’re targeting and what unique angle or solution you bring to the market.

Defining Your Niche

- Who are the buyers? (Demographics, interests, location, budget, pain points)

- What specific problem am I solving or need am I meeting?

- What solutions exist already, and how is mine different?

- Is my niche an offshoot of a larger market, or something entirely new?

Pro Tip:

If you can describe your audience and offering in one or two sentences that don’t sound generic, you’re on the right track.

Getting this clarity up front saves you from headaches down the line and makes it much simpler to test real demand later on.

Dig into Market Size and Growth Potential

Once you have a clear niche and audience, it’s time to figure out how big the opportunity really is. Market demand forecasting methods help estimate both current demand and future growth. Even if you’re running a small business, this step is super important.

Estimating Market Size

- Look at industry reports (Gartner, Statista, IBISWorld are worth checking out for trends in niche market analysis)

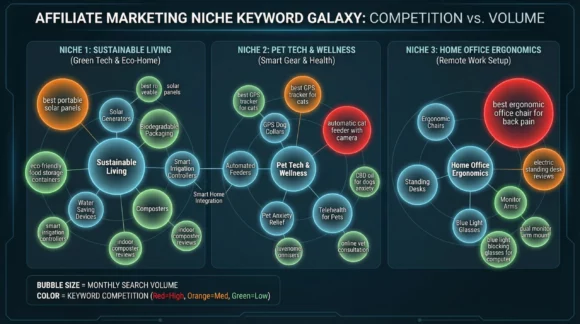

- Use Google Keyword Planner or SEMrush to find the monthly search volume for your main keywords

- Explore online forums and communities where your niche hangs out (Reddit, Facebook groups, Quora, etc.)

- Check the number of related products being sold on marketplaces like Amazon, Etsy, or eBay

- See if Google autocomplete and related searches are packed with suggestions for your primary topics

Spotting Growth Trends

Always watch to see if demand is flat, declining, or growing. Google Trends shows how interest in your core topics changes over time, while “Understanding market trends in 2025” reports can reveal emerging buyer habits. Listen for mentions of your niche in industry news, social postings, or podcasts to spot new developments fast.

Analyze Your Competition

Assessing the competitive landscape is essential for evaluating niche viability. Even in crowded spaces, being unique or offering a better experience can help you win. But you really want to know how tough the environment is before jumping in.

Questions to Ask While Scouting Competition:

- Who are the main players in your niche? (Brands, solo creators, service providers, apps, etc.)

- How do they market themselves? Check their reviews, websites, pricing, and product features.

- What are their customers complaining about?

- Where are the opportunities to stand out or improve?

Tools to Help:

- SEMrush and Ahrefs for analyzing search competitors and backlinks

- Amazon reviews, Trustpilot, or niche-specific review sites for honest customer feedback

- “Best of” blog posts in your market space

Don’t be scared off by competition. In fact, some is a good sign because it means there’s actual demand. Even if there are some big dogs, there might be underserved segments or missed features you can target.

Measure Real Customer Interest

When figuring out how to measure market demand, you want to move beyond theory and check if people are already spending money or time on what you offer.

Ways to Measure Real Demand:

- Survey potential buyers directly using social media, email lists, or tools like Google Forms. (Ask about their challenges, buying habits, price sensitivity, and what solutions they currently use.)

- Watch activity on Q&A sites and discussion forums—what questions come up repeatedly?

- Track “intent signals” like product preorders, waitlists, or newsletter signups

- If possible, set up a simple landing page with an offer and see how many people sign up or try to buy, even before you build out the full product.

Platforms like Kickstarter and Indiegogo double as demand tests for physical products. A pre-launch campaign can give you a sense of actual buying interest. Even a simple “Would you buy this?” poll on social media can provide early clues, especially if your followers are into your niche.

Understand Seasonality and Long-Term Trends

Some niches have steady, year-round demand, while others spike at certain times (think holiday gifts, back-to-school, or tax season services). Knowing these cycles helps a ton with market demand forecasting.

Seasonality Checks:

- Use Google Trends to visualize yearly search patterns for your niche keywords

- Ask suppliers or distributors about high and low seasons, if applicable

- Check historical sales data for similar products or services

Pay attention to long-term, global patterns too. Reports like “Understanding market trends in 2025” can point to tech adoption, demographic shifts, and new regulations—all of which can impact a niche’s future outlook.

Calculate Customer Lifetime Value and Acquisition Cost

Big market size numbers are exciting, but you need to be realistic about costs. Estimating how much it’ll cost to attract a customer, and how much each customer might spend over time, gives you a sharper view of how to evaluate niche viability.

Basic Equations:

- Customer Lifetime Value (CLTV): Average sale value × Number of purchases per customer × Average customer lifespan

- Customer Acquisition Cost (CAC): Total marketing and sales spend ÷ Number of new customers gained

If your cost to get customers is higher than the revenue they bring in, that’s a big warning sign. Small business market analysis often skips this step, but paying attention here helps you avoid surprises down the road and decide on profitability before launching.

Stay On Top of Technology and Tools

Now, more than ever, there are tons of software tools to help you research and spot market opportunities. The best market analysis software in 2025 is getting smarter, letting you quickly track demand signals, look at your competition, and forecast trends using up-to-date data.

Popular Tools Worth Checking Out:

- SEMrush – For keyword research, tracking trends, and analyzing competitors

- Ahrefs – Great for backlinks, niche content gaps, and top-performing topics

- Google Trends – For real-time trend tracking, plus spotting seasonality

- Statista – Uptodate industry data and forecasts

- SurveyMonkey – For running targeted market surveys

- Exploding Topics – To spot emerging topics and industries early on

Start out with free tools like Google Trends and search volume estimators. As you grow, consider advanced paid platforms; they provide more robust data and save serious time while reducing confusion.

Watch Out for Red Flags and Pitfalls

Small niches can be profitable, but there are warning signs worth watching closely:

- Very little existing search or buyer activity (maybe the niche just doesn’t have an audience yet)

- High customer acquisition costs with low purchase values

- Heavy dependence on only one or two sales channels (like only Amazon or only Instagram for traffic)

- Big competitors with unbeatable advantages that could block entry

No single red flag means you need to bail, but if several stack up, it’s a cue to look deeper or proceed with caution.

Practical Steps to Assess Demand in Your Niche

Pulling together these tips and demand forecasting methods can sound overwhelming, but here’s the exact process I use every time I size up a new idea:

- Write out your exact target audience and a one- or two-sentence description of your offer.

- Estimate search volume using Google Keyword Planner, SEMrush, and industry reports.

- Check out competitors and pin down any gaps, using reviews and competitor analysis tools.

- Survey potential buyers, and/or test demand with pre-orders, interest forms, or a simple ad campaign.

- Map out seasonality and look for longterm trends via Google Trends and industry forecasts.

- Calculate expected customer value and acquisition costs.

- Make your go/no-go decision: If you see solid demand, good acquisition costs, and opportunities to stand out, it’s probably worth a shot.

This approach gives you a realistic, actionable view. You’ll base your steps on facts, not just gut feelings and optimism.

Common Questions & Troubleshooting

How do I know if a niche is “too small”?

If your estimated customer base is super limited or your potential annual revenue is too low to make your effort worthwhile, you might want to broaden your audience or blend related groups together.

What if there’s almost no competition?

This might seem attractive, but it could suggest not enough demand. Make sure people actually search for or discuss your topic online before moving forward.

Should I always use paid market research reports?

Not necessarily. For most small business ideas or digital products, smart use of free tools and digital sleuthing is more than enough. Paid reports are only a must for high-stakes investments or pitching to major investors.

How long does niche market analysis take?

A quick vibe-check scan can be done in a weekend, but super detailed analysis takes a week or two—still much better than launching blindly and learning about low demand the hard way.

Don’t rush. Take the time to confirm your numbers and facts.

Final Pointers & Your Action Plan

Going after a niche with solid demand is one of the smartest moves for any entrepreneur. Solid research—not just hope—is what separates successful ventures from costly flops. Trends in niche market analysis keep changing, so use the best tools you can access and stay flexible as you learn more.

Your Step-by-Step Checklist:

- Define your niche and target buyer with specifics.

- Estimate demand through search data, online activity, and industry sources.

- Check out the competition for gaps and ways to stand out.

- Test real interest with surveys or pilot campaigns.

- Factor in seasonality and future trends.

- Crunch the numbers on customer value and acquisition cost.

Follow these steps and you’ll get a clear, data-backed view of your market. Your chances of creating something that truly clicks with buyers go way up, and you’ll avoid costly rookie mistakes.

Thanks for sharing an informative article!

Understanding niche market demand is all about getting clear on who you’re targeting, how big the opportunity is, and whether people are genuinely interested in what you offer. By defining your audience, analysing search trends, studying competitors, and testing real buyer intent through surveys or simple landing pages, you can quickly see if a niche has real potential. Combining demand signals, seasonality, and cost estimates gives you a grounded, data-driven view, helping you avoid guesswork and focus on niches where you can truly stand out and succeed.

Keep up the good work!

Thanks so much for your thoughtful feedback! You summed it up perfectly — understanding a niche really does come down to clarity, research, and validating real-world interest rather than relying on assumptions. I appreciate how you highlighted the balance between data, timing, and practical testing. That’s exactly the kind of approach that helps people make smarter decisions and avoid chasing ideas that look good on paper but lack actual demand.

Really grateful you took the time to share such a clear, insightful breakdown. Your perspective adds a lot of value to the conversation. Thanks again for the encouragement!

This article makes me rethink how often I still lean on gut feeling when choosing a niche, instead of sitting down with real data.

In my own online projects, the times I skipped proper demand checks were exactly the times I ended up with good content that nobody really needed enough to pay for.

If someone is just starting with almost no data, which two or three steps from your process would you say are the safest must do before spending on ads or building the full product? As the Ugandan proverb says, “If you don’t know where you are going, any road will take you there.”

I would love to learn more from you.

Thank you for this — that proverb from Uganda is perfect for the topic. It really captures what happens when we build based on instinct alone: you can work hard, produce something solid, and still end up nowhere because the direction wasn’t validated.

If someone is starting with almost no data, I think there are two or three “non-negotiables” from my process that give the strongest signal before spending on ads or building a full product:

1. Validate demand with search behavior.

Even a quick check using keyword tools or Google Trends tells you whether people are actively looking for solutions in your niche. If the searches are flat or near zero, that’s a big warning sign.

2. Look at what people are already paying for.

Scan marketplaces, competitor sites, or existing products. If you see recurring patterns — pricing, features people highlight, problems that keep coming up — that’s real-world proof of demand. It’s the closest you can get to “hard data” without having an audience yourself.

3. Run a tiny pre-validation test.

This can be as simple as a landing page with a clear offer and an email signup button. No ads needed — share it organically or in relevant communities. If the idea is strong, even small traffic will convert.

Those three steps don’t require a budget, but they dramatically reduce the odds of building something people don’t want.

Really appreciate your reflection — happy to share more anytime.